Short-Term Energy Outlook from the U.S. Energy Information Administration

Read the EIA's October report below:

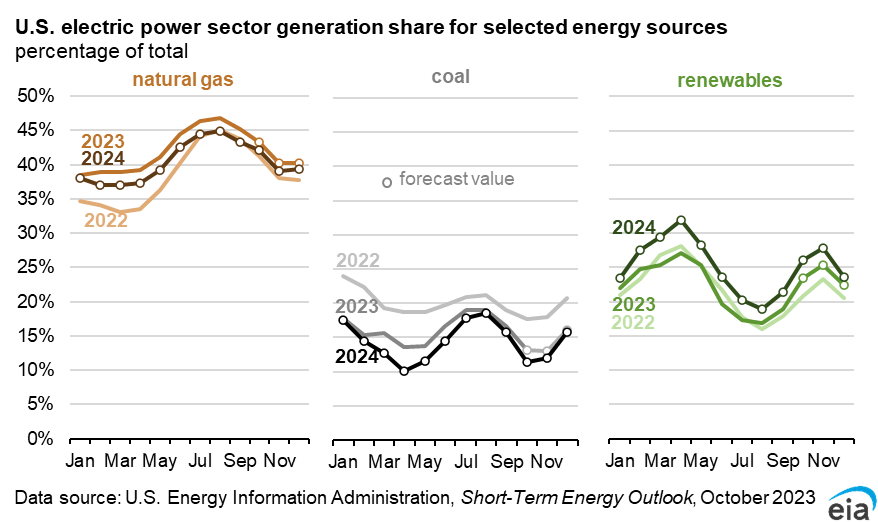

Electricity Generation

We forecast that natural gas will supply 41% of total U.S. generation in 2024, down from an average of 42% in 2023. This decline is offset by a forecast increase in the share of renewable generation from 22% this year to 25% in 2024.

In the forecast, natural gas-fired generation is more likely to be affected by the increasing availability of renewable generation than by fuel costs because growing renewable capacity, which generally has lower operating costs than thermal generation, will lead to less need to generate from natural gas and coal. Much of the increase in renewable generation is the result of new solar generating capacity added by the electric power sector, which we expect will rise by 25 gigawatts (GW) in 2023. An expected 8 GW increase in wind-generating capacity also helps increase generation from renewables. The share of combined solar and wind generation tends to peak in the spring months when overall electricity demand is low. The new renewable-generating capacity should reduce the share of natural gas- and coal-fired capacity in spring 2024 compared with last spring.

Although we expect the increase in renewables capacity to be the main driver of relative electricity generation shares next year, low natural gas prices, compared with coal, are also changing the relative use of the two fuels. Costs for generating power from natural gas have been much more volatile than the costs for coal. Between March and July 2023, we estimate that the cost of producing power from combined-cycle natural gas power plants averaged $25 per megawatthour (MWh), lower than the estimated $31/MWh cost for generation from coal-fired power plants. During the same months in 2022, the cost of operating combined-cycle plants ($55/MWh) was 90% higher than for coal-fired power plants ($29/MWh).

We expect natural gas prices to increase in 2024, which should bring the costs of generating electricity from coal and natural gas closer together. For all of 2024, our estimated cost of natural gas-fired electricity averages $32/MWh compared with an average $29/MWh for coal. We expect these similar costs will keep the share of U.S. generation from coal near 15% on average in 2024.

Coal Inventories

We forecast that coal inventories held by the electric power sector will reach almost 150 million short tons (MMst) in December 2023, a 66% jump over December 2022. The rising coal inventories this year are a result of a delayed response in production to the drop in coal-fired generation as coal producers fulfill supply contracts already in place. Although forecast natural gas prices rise slightly over the next few months, we expect coal inventories will increase until the spring of 2024, peaking near 170 MMst in May as the electric power industry gears up for summer power consumption. We forecast coal stocks will decrease from May 2024 levels back below 150 MMst in late 2024 as coal consumption goes through its normal seasonal drop in the fall.